- National Pension Helpline

- Posts

- National Pension Helpline - September 2024 Update

National Pension Helpline - September 2024 Update

September 2024

Hi ,

With the upcoming budget, we explore how investments are taxed in Ireland and highlight the disadvantages Irish investors face compared to their European counterparts.

We have also reviewed the proposed PRSI reforms. According to the ESRI and the National Pension Helpline, these reforms may fall short in adequately funding the Social Insurance Fund (SIF) to meet the future demands of the State Pension and the broader Social Welfare system.

Could this be a good place to park some of the €13 billion Apple windfall tax?

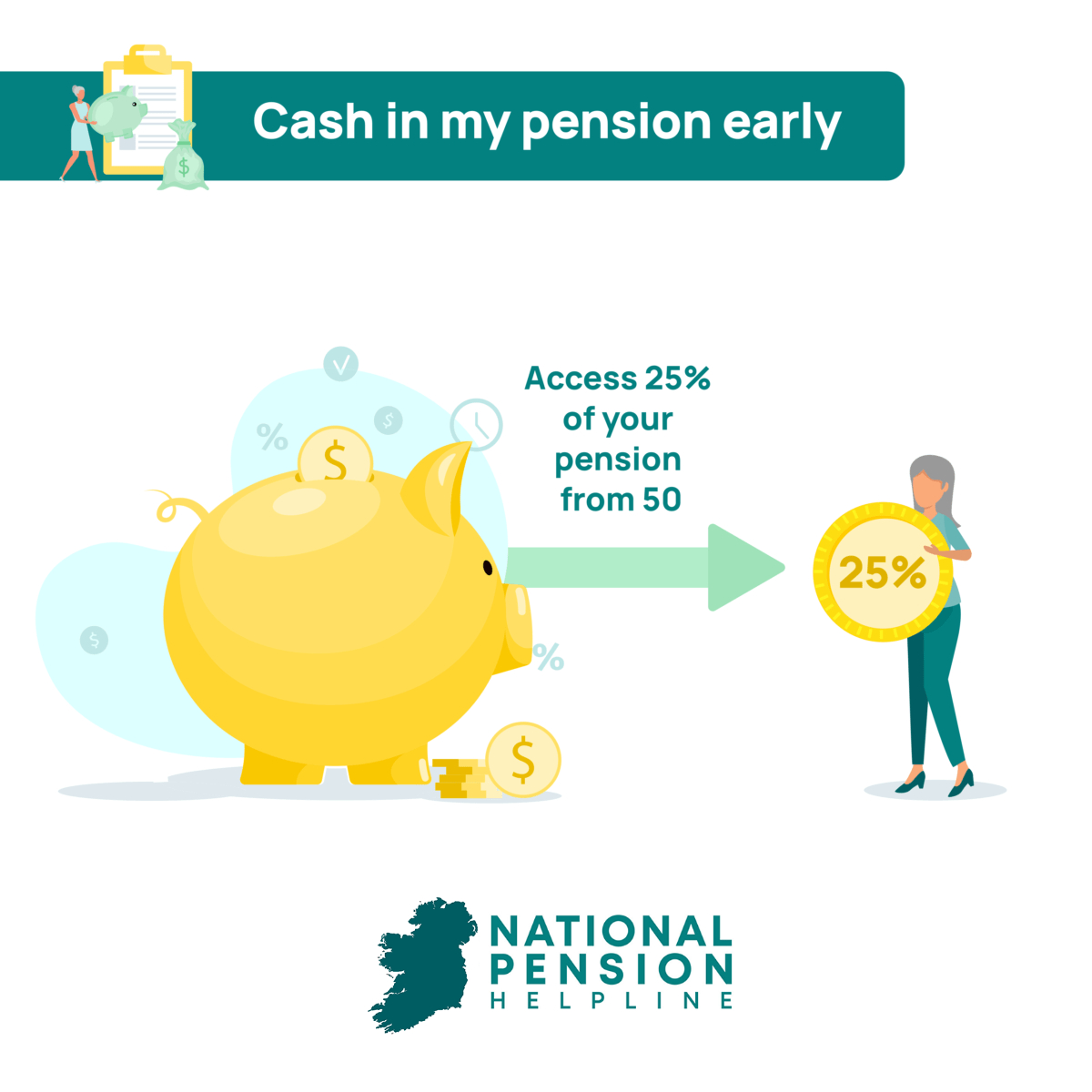

Do you have pensions with a former employer? If you are over 50 in Ireland you can access 25% of it tax free. Check out our article below to find out how.

Upcoming Topics:

✅ Budget 2025: Investor Impact Review

✅ Self Administered Pension Schemes (SAPS)

✅ The Irish Taxation & Investment Glossary

If you would like a particular topic covered or would like to contribute to next months newsletter please drop us an email to [email protected]